Looking into reducing customer returns? You’re in the right place.

And you’ve been there as a consumer yourself, I’d venture to guess.

Maybe your nephew is between sizes. Your partner tends to overestimate their technical ability. The 100-lb model does little to show you what the clothing item looks like on the average person. You didn’t realize how big a 9-foot rug actually is. The color of the product looks nothing like the image.

So you returned it.

Returns are a problem for most retail businesses—even more so for online stores. Some larger retailers have even made a successful business out of easy, free returns.

The problem is not every e-commerce business is set up for free, easy returns. But customers expect them to be.

Between 2019 and 2020, online retail sales more than doubled (for obvious reasons).

Shoppers took to the interwebs in drove—much more frequently or for the first time. But with increased sales came a deluge of returns.

The National Retail Federation reported that approximately $102 billion of e-commerce merchandise was returned in 2020. That came from $565 billion in e-commerce sales in the United States.

And 2021 didn’t do much better. E-commerce websites saw a 15% return rate, according to an IRMG report.

It has become a problem. Reducing customer returns is (or should be) a top priority for online, product-based businesses.

While returns are undoubtedly the cost of doing business online, a little customer service problem solving can go a long way. Continue reading for some strategies to reduce product returns with messaging.

The actual cost of returns.

Returns don’t just signify lost sales—they cost you money. The National Retail Federation survey found that for every $100 in returned merchandise accepted, retailers lose $5.90 to return fraud.

But fraud isn’t the only cost of high returns. Here are a few other costs incurred by frequent returns:

- Shipping costs

- Warehouse time spent verifying returns

- Customer service time spent emailing customers

- Operations time tracking shipping status

- Warehouse time spent restocking items

- Lost inventory due to damaged products

Simply ignoring returns and chalking them up to the cost of doing business online won’t work. It’s important your team learns about reducing customer returns—and even how to prevent them.

9 ways customer service can reduce returns.

When done well, customer service problem solving can help customers decide on the right product to begin with and help them post-purchase.

All it takes is thoughtful and frequent customer communication.

Here are 9 ways your support agents can use messaging to prevent frequent returns—and encourage repeat business from your customers.

1. Get ahead of problems with a few simple questions.

The first big question you should ask your customers is why. Why are they returning your products? Some returns are unavoidable, but some can be prevented with a little more information.

Is your sizing chart off? Is there a defect? Are the product photos misleading? Ask these questions with every return to identify easy changes you can make to your website or sales process to prevent them in the first place.

Have a more technical product? Collect frequently asked questions from your customer service team to post on your website or even send to customers once they’ve made a purchase.

Send an SMS/text message with common FAQs to ensure your customers see it (instead of getting buried in emails).

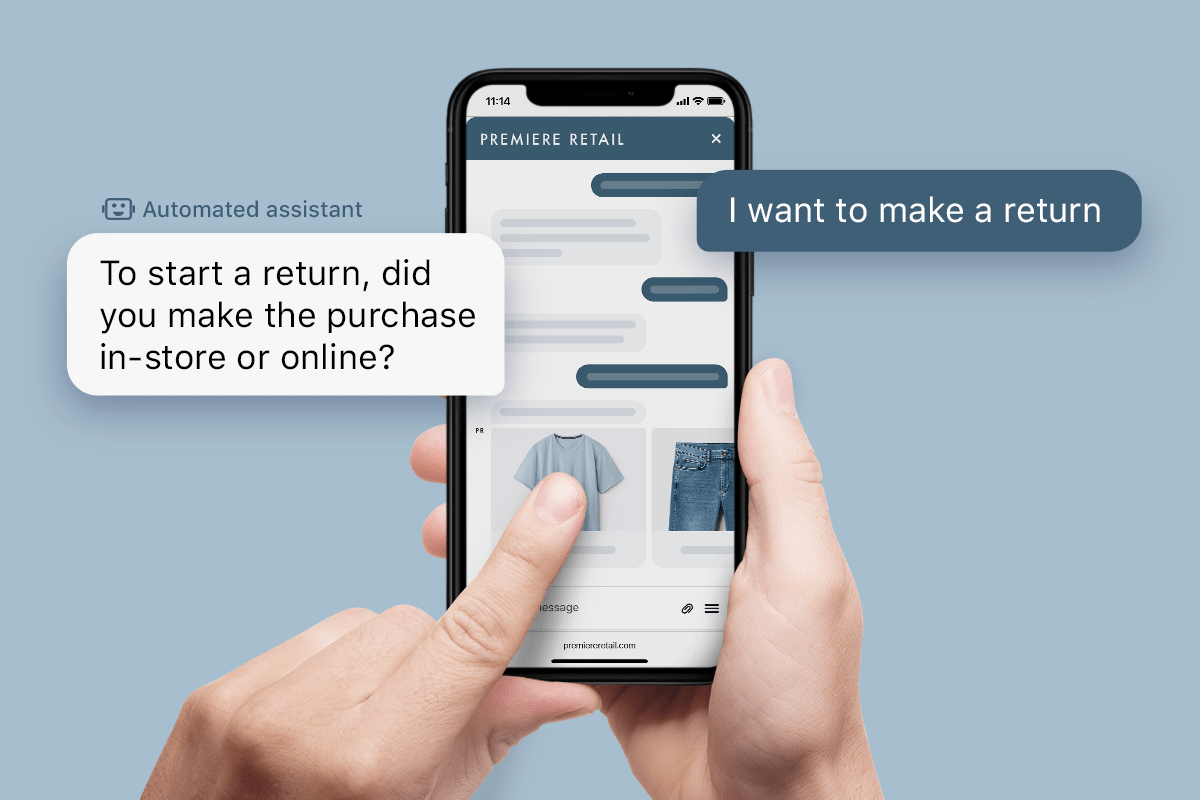

2. Use AI assistants to walk customers through simple troubleshooting first.

Is there an easy fix you can share with customers before they chat with your support team? Use bots and AI assistants to collect customer information, identify their support requests, and walk them through simple troubleshooting.

Make sure to keep it simple: Think “turn it off, wait ten seconds, then turn it on again” type instructions. Then loop in an agent to tackle more complex problems.

This could prevent returns from customers who think they may have purchased the wrong item, might have a defective product, or believe it’s too complicated.

3. Prioritize unhappy customers.

Customers (especially the unhappy ones) hate waiting for customer service. But during peak periods, a short wait is inevitable.

Using messaging and a conversational AI platform like Quiq can help you identify irate customers and prioritize them first with sentiment analysis. Quickly responding to angry customers gives your team the chance to turn the conversation around and troubleshoot issues before it leads to a return.

4. Get the message to the right person.

Another issue that leads to customer frustration: Call transfers. Even though they’re commonplace in call centers, customers hate them. They want you to solve their problems quickly and efficiently, but complex issues require extra help.

The last thing you want is to have frustrated customers giving up and returning their products.

Instead, lean into messaging. If you’re strategizing around reducing customer returns, messaging makes it easy to quickly identify the customer’s problem and get it to the right person (without multiple transfers, extensive hold times, repeating information, or awkward introductions).

5. Be optimistic instead of apologetic.

While empathy is a great customer service tool, you should always follow it up with optimism.

Try swapping out statements like “I’m sorry I don’t know how to fix this” for “Let’s get this solved. I’m going to bring in an expert to help us out.” Customers are more likely to respond to the second statement since it’s outcome-oriented.

Since you lose voice inflection with messaging, showing enthusiasm is even more important.

Don’t be afraid to use exclamation points (if your brand voice allows it). Find a balance between helpful eagerness and to-the-point problem-solving to fix customers’ issues and make them feel good about it.

6. Give customers a record of the conversation.

Giving customers information and directions over the phone is difficult. They could mishear things, skip steps, or forget the instructions immediately after the conversation.

Written instructions via messaging are much easier to follow.

You can walk your customers through troubleshooting at their own pace, and they can refer back to them whenever they need to. You can even email conversations to your customers so they can reference them whenever they need them.

7. Offer visual and interactive instructions.

Are instructions getting lost over the phone? Some customers respond better to visual instructions over voice and written directions.

With rich messaging, you can bring in diagrams, pictures, videos, and even augmented reality to help customers solve their product issues.

Rich messaging also works both ways. When customers have trouble describing their issues, they can send videos and pictures to show your customer service agents.

Your team will figure out the problem and how to fix it much faster than relying on imperfect customer descriptions alone.

8. Make it easy to loop in third parties.

Sometimes longer resolution times are unavoidable. Maybe there’s a system problem that needs help from a developer, or you need to reach out to a third party for replacement parts.

With messaging, customers can pick up conversations at a later date to check-in. Or they can opt to have the conversation emailed to them for quick follow-ups.

Plus, everything is documented. You can easily pass along the conversation to the third party without anything getting lost along the way.

9. Identify real problems.

Messaging makes it easy to track and document problems. This allows you to take a step back and identify opportunities to tweak other pieces of the sales puzzle.

Are shoppers surprised by what the product looks like? Maybe there’s a problem with your product images. Are customers disappointed with the results? Maybe your descriptions are overpromising. Are products arriving damaged? Are you not selling the product to the right demographic?

Use customer service messaging to identify problems that need to be addressed by your larger team, ultimately reducing customer returns.

Bonus tip: What to do when the product is actually defective.

Sometimes it’s not a user error or a problem that can be fixed from afar. Or maybe the customer is just genuinely disappointed with the product. What should you do then?

Restore their faith in your company. When you can’t prevent a return with excellent service, show your customers why they should continue doing business with you.

How companies handle returns (are they gracious and helpful, or do they make it as difficult as possible) has a big impact on customer perception. This is where you earn a repeat customer.

Reduce customer returns with messaging.

You may not be able to get rid of returns completely, but you can certainly lower them.

Messaging is a great way to engage your customers before and after a purchase to ensure they’re getting the right products and know how to use them.

Reducing customer returns starts with a good website, amazing products, and great customer service. Once you have those things in place, it just takes a little strategy.