For many consumers, purchasing a product is about more than just the product itself. Consumer demands continually grow as they prefer faster and higher quality customer service from brands. That’s why many businesses today are choosing to implement a more effective online customer service experience strategy. eCommerce businesses are ramping up their digital customer service to make sure their customers keep coming back to them instead of exploring other options.

How to Improve Your eCommerce Customer Service Strategy

Online shoppers want instant replies and easy answers. eTailers that are catering to their customers in these ways will benefit from consistently refining their service, sales, and marketing communication strategies. Five common ways to improve eCommerce customer service include the use of the following communication channels and automation.

1. Text Messaging

Text messaging for customer service is fast and convenient making it easy for eCommerce companies to connect with consumers to assist in shopping cart conversions and follow-up with pertinent order information. This shopper-friendly channel allows consumers to be on-the-go, and in this busy world, text messaging has become the channel of choice for receiving information, solving problems, and answering urgent questions.

Consumers prefer text messaging because they are able to start the messaging conversation while on a mobile eCommerce site and finish them at their convenience while moving about in their normal life. Imagine an online shopper sending a message to a brand requesting help getting the details of their online shopping cart correct, but then needing to get on with their busy day. The agent could build and confirm the order and send a link back to the consumer via SMS. The consumer can then click the link that would send them to a secure mobile web page where they can confirm the contents of their shopping cart and complete the purchase securely.

An asynchronous conversation like this allows for eCommerce businesses to move at the speed and cadence of their customers, making for better customer experiences and more modern shopping experiences.

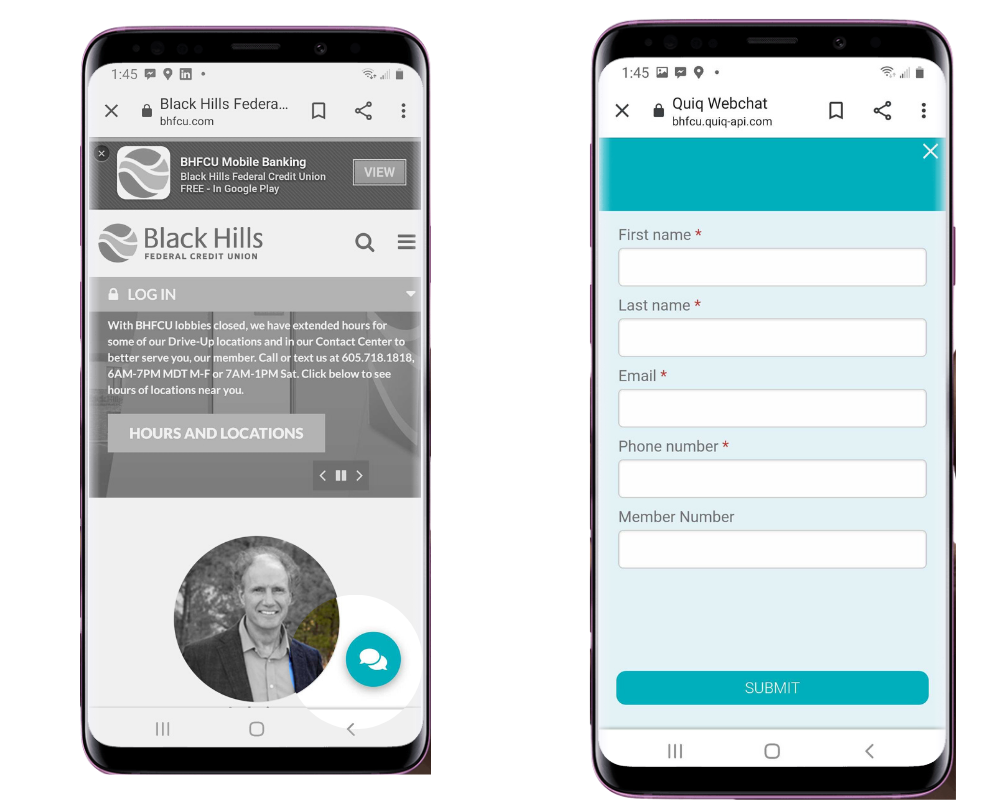

2. Web Chat

When it comes to eCommerce and enabling customers with a fast and easy way to get in touch, web chat is the most obvious choice. Customers on your website may have a multitude of options for finding answers, like an FAQ page, sending an email, or calling, but none help customers as fast as the omnipresent option of web chat, typically presented in the lower right corner of your website.

Online shoppers expect fast answers when they are adding items to their shopping cart or in the process of completing a purchase, similar to when they are shopping in-store. Without web chat, customers may save their purchase for another day, or find what they are looking for elsewhere altogether. This is why the messaging channel is a critical part of any eCommerce website to ensure customers find what they are looking for and are being helped at every point in the customer journey, from product recommendations to purchase confirmations, and being available for any follow-up questions. Never miss a chance to answer customer questions or assist in a sale.

3. Social Media Messaging

The market for customer conversations has grown beyond websites and call centers to include social media platforms, which is why more than 90% of businesses today have some form of social media presence. Consumers have not limited themselves to engaging with and conversing about brands to only in-person interactions and are now expressing themselves in more amplified ways across platforms like Facebook and Twitter.

eCommerce companies can engage with their customers across these social media platforms to build advocacy and highlight their brand in the broader marketplace. These platforms offer more opportunities to connect with consumers in direct messages to answer questions and be a part of the conversation. Consumers are becoming increasingly agnostic to where they expect brands to provide support, and social media is an example of where conversations are happening and where brands need to ensure they are part of them.

4. Outbound Messaging

Online retailers reap huge rewards by keeping their customers in-the-know. A prime example is regarding order status. Customers feel better when they know what to expect, like if their package may be late or even to hear it’s arriving early. Never miss an opportunity to delight customers.

Outbound text messaging is an incredibly effective way to communicate with consumers, particularly if you consider they are reading texts at a rate of 98%. With this much attention being paid to text messages, it becomes an great opportunity to entice them with upcoming specials or promotional codes.

The best solutions don’t stop at just sending outbound messages. Businesses should also enable 2-way conversations so consumers can respond and have agents or bots standing by to help answer any questions.

5. Chatbots

Retailers and eCommerce companies are increasingly leaning on the efficiency and cost savings that chatbots provide. Chatbots are always available to answer pre- or post-sales questions, assist shoppers with their selections, provide order and shipping information, and answer common questions.

Chatbots are truly revolutionizing eCommerce to encourage more sales and are becoming a key part of customer service strategies to improve customer satisfaction. Research indicates that the chatbot market will grow to 9.4 billion by 2024 at a growth rate of almost 30%, which means it’s predicted to become mainstream in the coming years.

Chatbots are increasingly important for companies with high volumes of traffic to be able to deflect questions that can be answered with an automated response, to resolve issues more quickly. This is critical in assisting agents and routing the most high-value conversations from consumers for extra-special customer care.

Contact Us for a Demo

You can improve eCommerce customer service for your business in a number of ways, from implementing business messaging software to including automation with bots into your customer service strategy. Whatever your company’s goals, Quiq is here to help you find the ultimate online customer service solution. Contact us today to request a demo.

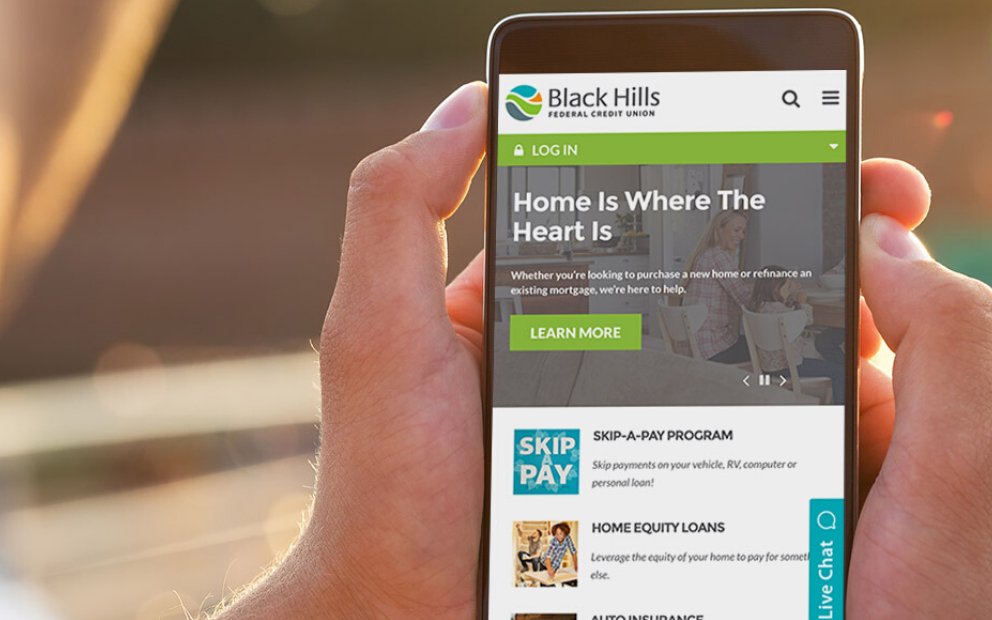

Black Hills Federal Credit Union (BHFCU) is proud to be a part of the community they serve. They help members who are spread out across SouthDakota buy their first home, their first car, that second home, and even start businesses.

Black Hills Federal Credit Union (BHFCU) is proud to be a part of the community they serve. They help members who are spread out across SouthDakota buy their first home, their first car, that second home, and even start businesses.

The team at Black Hills decided to take things slowly to get a feel of the new channel and implemented Quiq for inbound texts only. Getting started with Quiq was straightforward and happened quickly. In the words of SVP/CIO John Buxton, “Implementation was super smooth.” The credit union has since added web chat, outbound messaging, and integrated messaging with their IVR system.

The team at Black Hills decided to take things slowly to get a feel of the new channel and implemented Quiq for inbound texts only. Getting started with Quiq was straightforward and happened quickly. In the words of SVP/CIO John Buxton, “Implementation was super smooth.” The credit union has since added web chat, outbound messaging, and integrated messaging with their IVR system.

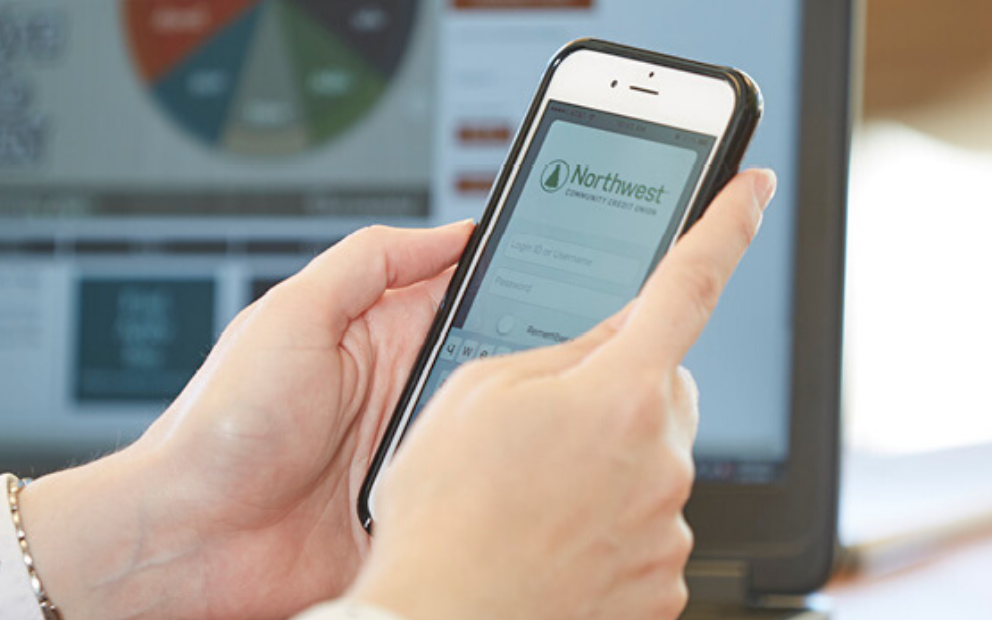

The intuitive nature of texting and Quiq’s interface made employee training easy, providing the flexibility the organization needed during the staffing turmoil of the pandemic. “The beauty is that it’s so easy we’ve been able to have employees from all over the organization, including many employees who have never talked to members, using the channel, supporting them, and it’s just been seamless, so that’s been really great. It’s been the silver lining in rolling out something in the midst of COVID.” says April Cooper, Director of Digital Experience at Northwest Community Credit Union.

The intuitive nature of texting and Quiq’s interface made employee training easy, providing the flexibility the organization needed during the staffing turmoil of the pandemic. “The beauty is that it’s so easy we’ve been able to have employees from all over the organization, including many employees who have never talked to members, using the channel, supporting them, and it’s just been seamless, so that’s been really great. It’s been the silver lining in rolling out something in the midst of COVID.” says April Cooper, Director of Digital Experience at Northwest Community Credit Union.