Customer Spotlight: evo & Quiq Messaging

evo, a leading online retailer of outdoor gear and fashion apparel is known for exploring the collaboration between culture and sport by seamlessly joining art, music, streetwear, skateboarding, snowboarding, skiing, mountain biking and wakeboarding. Their aim is to bring all things relevant to the urban, action sports lifestyle into one creative space.

Why Messaging?

Focused on going beyond the typical sales experience, evo knew it had to provide a cutting-edge support experience. Based in Seattle, Washington, evo is a retailer that offers top-notch gear and clothing for outdoor sports enthusiasts.

When consumers had questions, they used to only be able to call or email the company to get an answer. Now, using Quiq Messaging, evo’s customers get swift responses via Facebook Messenger, live chat and text messaging-channels that are often preferred or more convenient for their active, on-the-go consumers.

Easy For Customers to Engage

Some customers contact evo for help during the purchasing process with very specific product comparison questions. Others have questions about shipping and a possible return. While still others need technical help with a product they just purchased. Regardless of the question, evo’s customer care center is ready to answer. And customers are happy with the choices of channels over which to contact evo.

When a customer is on evo’s website, if an agent is available, the live chat image will automatically appear on the bottom-right of the desktop, making it easy for a customer to start a chat conversation. And, text messaging is offered on its mobile website. Customers are excited to be able to engage with evo via text messaging. It’s fast and it’s convenient.

“Certain people like to communicate via specific channels and with Quiq Messaging we are able to serve more people in the manner in which they want to engage. That’s a big win for us and our customers.”

Justin Courtney, Customer Care Manager, evo

Efficient For Agents

Top agents can easily handle live chat and text messaging conversations, on top of the phone calls and emails they are already answering. Since Quiq supports live chat, text messaging, and Facebook Messenger, evo agents only have to log into one application. Quiq is so easy-to-use that all agents are able to support all channels. During peak winter months, evo has the ability to dedicate agents to manage real-time interactions based on increased volumes to ensure response times are kept in-check.

After introducing live chat, it immediately accounted for 11% of support inquires. Phone volumes dropped by 8% and emails inquires decreased by 3%. That trend has continued to follow the same track with Quiq’s live chat and text messaging solution, which now represents 22% of the overall support volume.

What the Future Holds

Looking ahead, evo plans to integrate Quiq Messaging with their NetSuite implementation to consolidate all customer contact data, which will both improve the customer experience and yield additional opportunities through improved reporting. They are also planning to build out the visibility and promotion of its new messaging capabilities on their mobile website.

About Quiq

Quiq makes it easy for customers to contact a business via Messaging, the preferred channel already in use with our friends and family. With Quiq, customers can now engage with companies via SMS/text messaging, Facebook Messenger, Live Chat, and Kik for help with their pre-sales and post-sales questions. Learn more about Quiq today at quiq.com.

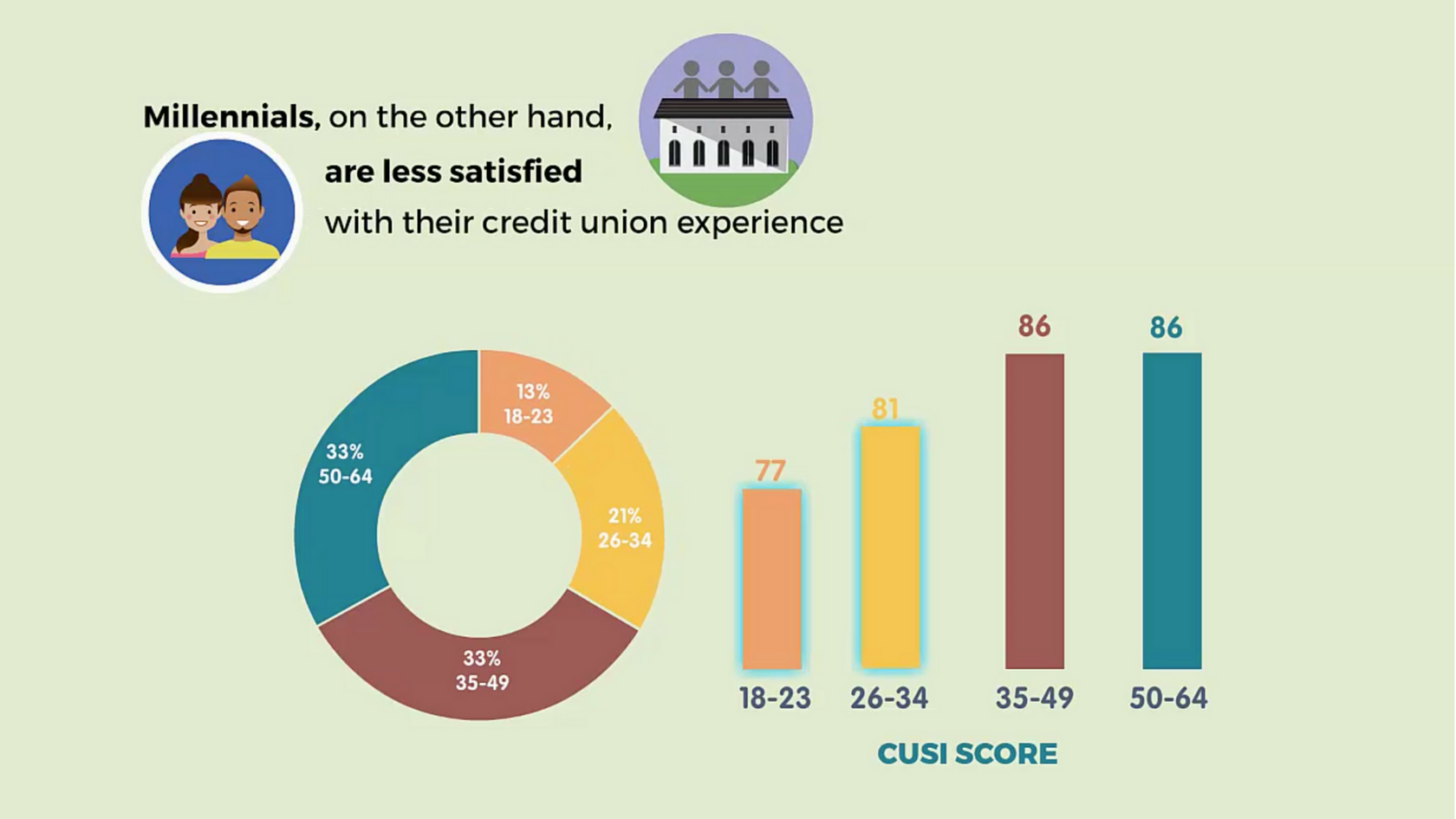

One of the main reasons for the lower satisfaction score is the digital experience gap. The Millennial generation is much more digitally connected and comfortable with online transactions than previous generations. Targeting Millennials and increasing overall customer satisfaction will require credit unions to reduce the effort it takes to do business with their institution. Obstacles, such as members having to repeatedly contact the credit union or repeat information, can be eliminated with the use of technology like Quiq, which enables customers to easily connect with their institution over their mobile device and at their convenience.

One of the main reasons for the lower satisfaction score is the digital experience gap. The Millennial generation is much more digitally connected and comfortable with online transactions than previous generations. Targeting Millennials and increasing overall customer satisfaction will require credit unions to reduce the effort it takes to do business with their institution. Obstacles, such as members having to repeatedly contact the credit union or repeat information, can be eliminated with the use of technology like Quiq, which enables customers to easily connect with their institution over their mobile device and at their convenience.

The Equifax Security Breach service page left some customers wanting more definitive answers.[/caption]

The Equifax Security Breach service page left some customers wanting more definitive answers.[/caption]

1. Quiq Messaging helps convert tentative buyers into customers.

1. Quiq Messaging helps convert tentative buyers into customers.