Retailer Pier 1 Imports, has been around for 56 years and knows a thing or two about evolving within a competitive retail market. The importer of home goods and seasonal products also knows about catering to the changing and diverse tastes of their customers.

Shifting Buyer Behavior

Pier 1, as well as all other retailers, are experiencing growth in mobile shopping and purchasing as customers continue to look for ways to buy that are more convenient for them. The company made it a top priority to make their customer experience “easy and effortless”, so that she could shop when, where, and however she liked. The retailer launched its eCommerce channel in July of 2012 and has seen rapid growth in the online sales.

“As the business model became more complex, we realized that a lot of our systems were outdated legacy systems and we needed to upgrade our technology to make our associates more efficient.”

Laurie Simpter, Senior Manager, Customer Relations, Pier 1 Imports

During the first three years after implementing their eCommerce site, their contact center struggled to keep up with the new volume.

Pier 1 decided to implement Quiq’s messaging software as consumer traffic to the pier1.com site continued to grow. The shift to more digital channels proved to be, once again, an evolution to serve their customers better that allowed the company to have a more efficient conversation with their customer.

Motivated by Mobile

The leadership team recognized that email and phone weren’t the most effective or preferred ways for customers to ask questions. It was also suspected that the inability to quickly answer these simple questions in-line negatively impacted website conversions and sales.

Many retailers are experiencing similar issues with email and phone as consumers’ contact preferences have changed. Research shows that 66% of consumers rank mobile messaging as their first or second choice to contact a company.

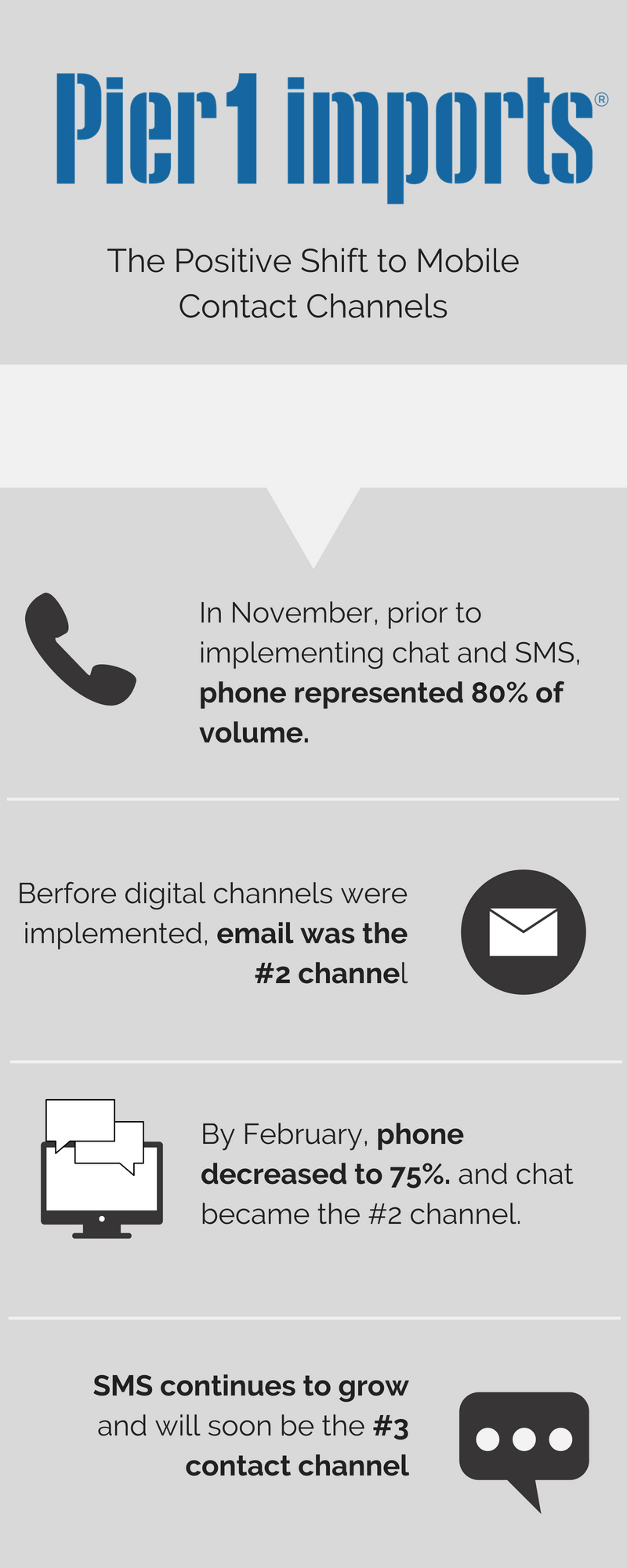

The company started with chat as a contact channel. The channel was readily accepted, and volume grew rapidly while positively impacting website conversion.

With the effectiveness of chat and an increase in mobile traffic to the website, Pier 1 looked at SMS/text messaging for their mobile site as the next obvious channel. While the retailer normally targets the 35 – 55 age group, they realized that their customer could be any age and that a younger buyer generally uses SMS and text messaging as their preferred channel over phone and email.

Q: What made you look at SMS as a contact channel?

A: SMS combines the efficiency of chat with the convenience of email – which is not an immediate response channel.

The ability to easily share pictures was another customer-driven requirement. Whether it’s a space they are trying to decorate, an item they are trying to match, or a damaged product they received, the ability for customers to easily share photos and videos from their mobile device directly supports the “effortless experience” Pier 1 seeks to deliver.

Implementing with Efficiency

Prior to launching the eCommerce channel, the contact center had about 25 agents and supported 2 contact channels – phone and email. Contacts were heavily skewed towards supporting stores. The company used a legacy CRM and had over 25 siloed systems & applications that contact center agents accessed for data.

The company has integrated many of their siloed systems into just a handful, and grown its contact center to over 150 agents with over 85% of

the contact center conversations driven by website and eCommerce purchases. The company also invested in a new CRM solution. Streamlining and efficiency have been top priority over the past few years. The addition of the messaging channel had to complement the company’s efforts.

Quiq Messaging did not disappoint. Once Pier 1 decided to add SMS as a channel, implementation took about 2 weeks and went live in December 2017. In fact, Chris Thompson, CX Manager at Pier 1 feels it was “one of the easiest implementations we have ever done.” Quiq’s messaging platform also seamlessly integrates into Pier 1’s new CRM system, right inside the agent UI, both ensuring the messaging channel wasn’t siloed and that the agents could easily handle inquiries from multiple channels from one interface.

“Every company wants efficiency. For us, chat and SMS interactions take about half of the total time of a phone call. We are gaining payroll efficiency by shifting contacts away from phone and email to chat and SMS.”

Chris Thompson, Pier 1 Imports

Lessons Learned

Lessons Learned

Pier 1 learned 2 really important lessons about the SMS channel, right from the start:

1. Phone and email decreased; chat and SMS increased

2. Customers LOVED the convenience of directly messaging Pier 1

The retailer saw a measurable channel shift. Customers shifted away from phone and email to chat and SMS.

Q: How have customers responded to the SMS channel?

A: Our customers loved the convenience of SMS. Within the first 30 minutes of going live, one of our customers said, “Wow, I had no idea that Pier 1 had a texting option and it was so easy. I am using this from now on. Thank You!”

What’s Next

Pier 1 feels that they’ve reached a state of proficiency with SMS, and seeks to expand its presence in their short and long-term roadmap. For the short term, Pier 1 will add a ‘Text Us’ option within the phone channel (IVR) for when hold times reach a pre-determined threshold. They will also be limiting phone hours with an IVR message encouraging customers to reach out to the company through text messaging.

With the continued focus to create an effortless experience for their customer, Pier 1 plans to add a messaging option to social media channels, while expanding messaging options to the desktop and tablet website instances.