So much time and effort is spent on customer acquisition. Marketing and sales consistently combine their efforts to attain the most customers at the lowest price.

But few businesses dedicate as many resources to customer retention.

And that’s a big mistake. Keeping customers happy and continuing to buy from your e-commerce business deserves (and often requires) as many resources.

Customer retention is a struggle for e-commerce businesses, and it’s only become more difficult since the pandemic.

Even as more people move their shopping online, there’s more competition than ever before.

Despite the struggles businesses across industries faced, 61% of customers say the pandemic has actually raised their customer service standards, according to Zendesk.

Challenges continue to plague e-commerce businesses, from staffing shortages to supply chain issues.

With higher standards and more difficulties, retaining customers is a struggle.

But focusing on customer retention strategies will help your e-commerce business keep customers happy and revenue high.

In this guide, we’ll deep dive into customer retention and provide tips on how to improve it.

What is customer retention?

The meaning of customer retention is the measurement of a company’s ability to keep customers. It’s important because it helps a company measure how good they are at satisfying customers.

It’s also often less expensive to retain customers than acquire new ones.

There are many metrics related to retention, including customer churn (also customer attrition), customer lifetime value, purchase frequency, etc.

Evaluating your customer retention rate starts with a simple formula, but it’s important to look holistically at your numbers to see what’s working and what you can improve.

How do you calculate customer retention?

Here’s a simple calculation to identify your customer retention rate (CRR):

(# of customers at the end of a given time period – # of new customers in a given time period ) / # of customers at the start of a given time period x 100 = CRR

For example, here’s what the number would look like if we were measuring customers from January 2022 to March 2022:

[2,000 (total customers in March 2022) – 1000 (new customers between January and March)] / 2,000 (total customers in January 2022) x 100 = 50% CRR

How do you calculate your churn rate?

The customer churn rate is the opposite of your customer retention rate. So in the above example, your CRR is 50%, and your churn rate will also be 50%. If your CRR was 75%, then your customer churn (or attrition) rate would be 25%.

Why do e-commerce businesses struggle with customer retention?

Many businesses struggle with customer retention, but e-commerce and e-tail businesses face an uphill climb.

Some businesses struggle to increase their retention rates, while others simply don’t even put together a customer retention strategy.

Here are a few reasons why e-commerce companies might be struggling.

E-commerce differentiators are harder to spot.

Customer retention often relies on brand loyalty, but e-commerce businesses often have a harder time standing out.

Because many retailers offer similar products with similar levels of quality, customers find it difficult to spot differentiators.

Without a branded storefront, an in-store customer service experience, and other tactile identifiers, it’s easier to compare e-tailers based on things like price and convenience.

Since these factors change often, it makes e-commerce companies appear interchangeable.

Brands think retention is only about their product or service.

While we know the mantra “so good it sells itself” rarely works, people are much more inclined to think it’s true when it comes to customer retention.

A common opinion is if the product or service you’re selling is truly great, retention should be a no-brainer.

But that’s not always the case.

While the quality of what you’re selling is a vital factor, retention takes careful strategy just like any other business tactic. Ignoring retention and hoping for the best is a recipe for disaster.

Acquisition is easier to track.

Anything that’s easier to track (and prove ROI) is much easier to justify. There are certain indicators that help track retention, like CRR, but they don’t paint a bigger picture of the business and take a while to see.

While customer acquisition has immediate metrics, retention metrics like customer lifetime value (CLV) are harder to nail down.

Companies with monthly subscriptions or those that sell frequently-used products can determine fairly quickly how they’re performing.

However, companies selling long-lasting products might have a harder time.

For example, a retailer that sells computers won’t have retention numbers until after they release multiple new models.

Since people only get new computers every few years, it’ll take at least that long to see if customers are returning to buy the new product.

It’s harder to see what’s not working.

Since customer retention rarely has a start and end date, making changes and tracking the results is a much slower process than high-speed customer acquisition.

It’s hard to see if customers are just enjoying their previous purchases longer or if customer retention strategies aren’t working.

Taking the computer example from above, it’ll likely take years to implement customer retention strategies, measure them, and make adjustments accordingly.

Customer retention statistics you should know.

A great way to get started and ensure you have a thorough understanding of customer retention is to dive into the statistics. Here are a few insights we pulled based on recent data.

Customer retention is a high-stakes game.

While Statista reported in 2020 that online retail businesses see a 22% churn rate (which equates to a 78% customer retention rate), Omniconvert reported that e-commerce businesses average only 30% CRR.

While these stats vary widely, it’s easy to see how retention could remain low for e-commerce businesses. The best CRR to benchmark your business against is your own.

Competition is tough, and it doesn’t take much for customers to switch retailers.

According to Zendesk’s CX Trends 2022 report, 61% of customers would now defect to a competitor after just one bad experience. Bump that up to two negative experiences, and 76% of customers are out the door.

Customer retention is cheaper.

Despite the flashy appeal of customer acquisition, it’s actually easier and more cost-effective to focus on customer retention.

According to American Express, it costs 6 to 7 times more to acquire a new customer versus keeping the customer you already have.

There’s also an old Bain & Company statistic quoted by almost everyone who talks about customer retention that says a 5% increase in customer retention can increase company revenue by 25-95%.

However, we advise you to take this with a grain of salt since it’s an outdated (and frankly vague) stat. We only include it here since it frequently makes the rounds on social media and in the blogosphere.

Despite dubious statistics, no one doubts that customer retention is an underused and undervalued tactic for increasing revenue.

Customer service and customer retention are intertwined.

Customer service is a big part of customer retention. While many business leaders think of customer support as an expense, it’s actually a big revenue generator.

In fact, Zendesk reported that 60% of business leaders agree that customer service improves customer retention.

Customers feel the same way: 81% say a positive customer service experience makes them more likely to make another purchase. This makes a lot of sense.

When customers have as many choices as they do today, they’re not likely to make multiple purchases after a bad experience.

Customer service’s impact also extends to revenue: 73% of business leaders report seeing a direct link between customer service and business performance.

Customer loyalty is all about emotion.

Customer loyalty is also talked about in the same breath as retention. Loyal customers are often your biggest source of sales, in addition to being brand evangelists.

So what does it take to endear a customer and make them loyal to their brand? Emotion.

According to Salesforce’s State of the Connected Customer report, 53% of customers say they feel an emotional connection to the brands they buy from the most.

Remember the old adage: People won’t remember what you do, but they will remember how you made them feel.

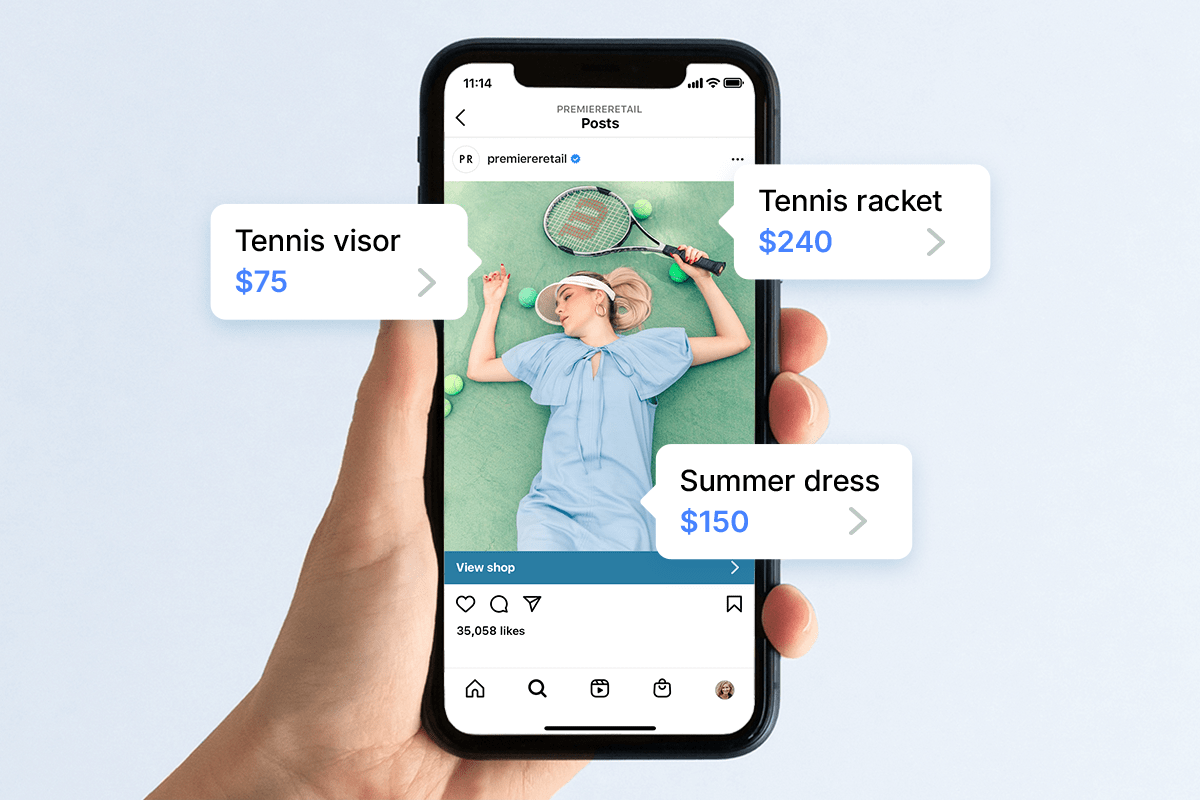

Personalization is quickly becoming table-stakes.

Customer expectations have a big influence on whether they continue to purchase from your e-commerce business. And personalization is something they’ve come to expect.

Salesforce found that 52% of customers expect offers to always be personalized. This number has jumped from 49% in 2019, and experts expect it to continue increasing.

While privacy concerns are at the top of customers’ minds, they also want businesses to know them and their preferences.

Convenience is the ultimate factor.

One thing the pandemic has taught us is that e-commerce brands must put convenience above almost everything else.

In the Zendesk CX Trends Report, customers admitted that 70.5% prioritize convenience over brand.

That means things like your checkout process, shipping procedures, and customer support features must all be frictionless to keep customers coming back.

The good news: Customers are interested in automated services if it makes their lives easier.

Here are some statistics of customers who are using or interested in using the following services:

- Self-service account portals: 82%

- Pre-orders for new or out of stock items: 80%

- Chatbots for customer service: 70%

That means customers are open to automation, and you can take advantage of these services to streamline your customer service processes.

Investment in customer service and support is far behind business growth.

If customer service has such a direct impact on retention (and retention is cheaper and more effective than acquisition), that means the budget should reflect that. Right?

Unfortunately, that’s not the case.

Only 27% of business respondents strongly agree that their organization is adequately investing in support initiatives, according to Zendesk.

Customer service is growing, but is it enough?

Half of companies expect to increase funding by 25% by next year and another 25% the year after that.

Part of the problem is that many companies still view customer service as a cost center rather than a vital factor in customer retention and revenue growth.

What do these statistics tell us about customer retention? That there’s a lot of room for growth.

6 tips to improve customer retention in e-commerce.

Are you just starting to track your numbers or need some additional customer retention tips? Tap into these 6 customer retention strategies to boost your bottom line.

- Track the right metrics.

Your CRR and churn rate are good starting points, but you should also track recency rates (how recently a customer has made a purchase), frequency rates (how frequently a customer makes a purchase), and customer lifetime value.

Gathering these numbers will help you identify customer pain points and figure out the best time to engage with them.

It’s also important to track metrics that speak to deeper brand relationships, like Net Promoter Score®.

NPS® measures customer loyalty, which has a strong correlation with overall business growth. Figure out which metrics make the most sense for your business.

2. Lean into customer relationship-building strategies.

It takes personalization to build customer relationships en masse. As we mentioned above, it’s table stakes.

Customers expect simple personalizations like using their names on websites and in emails or offering product suggestions based on past purchases.

In order to stand out, you need to do more.

Consider curating product collections for customers. Try putting together customer profiles and deliver suggestions based on their preferences. Identify shopping patterns and craft email or text message touchpoints to reengage them at the right time.

There are many opportunities to give your customers the personalized shopping experience they crave.

3. Invest in the post-purchase customer experience.

What is your customer experience like after a purchase? Just ask your customer service agents.

While it’s likely they’re also answering questions and cross-selling before customers click buy, much of what your customer service team does happens after the purchase.

Here are some quick wins that have a big impact on whether customers come back:

- Make the return/exchange process frictionless.

- Provide order tracking via text message.

- Ask for customer reviews.

- Send helpful emails that go beyond transactional exchanges.

- Ensure customer support is available should anything go wrong.

4. Don’t forget about the entire customer journey.

Retail loyalty is all about how you make the customer feel.

Every step of the customer journey has an impact on whether a customer makes a second purchase.

What was your checkout process like? Did they have to go searching for a phone number on your website to reach customer service? Were the products delivered damaged?

Any inconvenience can throw up a red flag and prevent customers from purchasing from you again.

5. Keep customers engaged.

Engaged customers stick around and buy more. There are several ways to keep customers engaged post-purchase:

- Start a loyalty program. Customers love free stuff, and they’re willing to engage with your brand in order to get it. Loyalty programs offer endless opportunities for engagement, from posting product pictures to writing a review.

- Build social communities. Brand communities are a hot topic. Try bringing customers together with a Facebook page or use a branded hashtag to highlight a promotion.

- Offer exclusives. Exclusive deals are hard to pass up. Offer past customers early access, exclusive discounts or special merchandise to drive repeat sales.

6. Craft a customer listening program.

This goes beyond reviews. To encourage repeat business, you need to improve products and services—and the customer experience.

Deploy customer surveys, like NPS, customer satisfaction, and customer effort scores, but don’t stop there.

Try out different surveys and see which ones get the best feedback from customers that actually help your business improve.

Not only will you end up with a better product and customer experience, but customers will feel heard and respected—endearing them to your brand.

Make customer retention a top priority.

Focusing on customer retention won’t yield overnight success, but it helps improve customer satisfaction and boosts your bottom line.

With these customer retention tips, you can craft a long-term strategy to make every customer feel appreciated and come back for more.