The Quiq Blog

The latest news and expert advice on AI, CX, and customer service.

AI | 6 min read

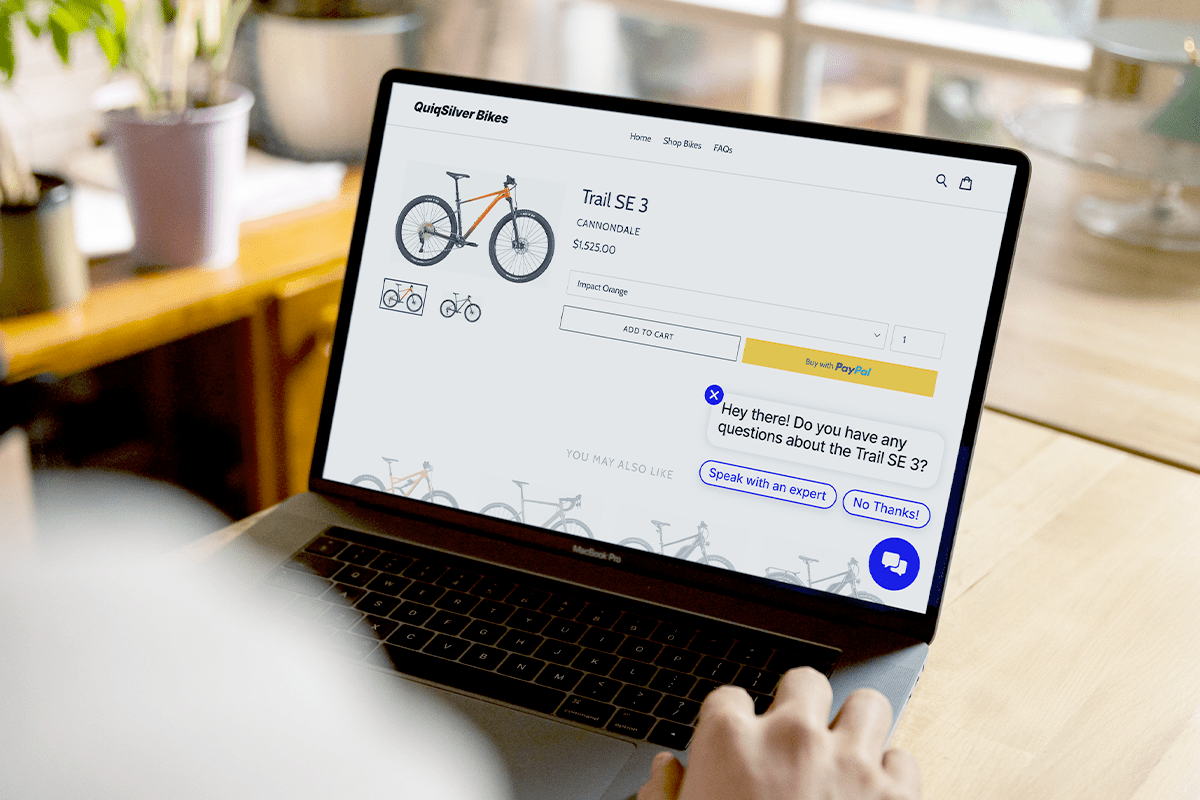

Let’s Talk AI in Sales: Why I Believe AI Agents Are Your Next Revenue Superstars

Key Takeaways

Shift your mindset from cost-saving to revenue generation. AI sales agents are powerful tools that ...

More posts