Mobile Millennials – How to Attract Them to Your Credit Union

Credit unions have long been viewed as the more local, approachable place for multiple generations to manage their finances. During times of financial crisis – recessions and dot-com busts, Credit Unions have gained the trust and admiration of Boomers and Gen-Xers who make up two-thirds of today’s total credit union membership. Today, the average age of a credit union member is 48. Credit Unions continue to appeal to these generations with the right products, services, and messaging. However, in order to increase members and grow revenue, Credit Unions will need to attract and engage Millennials as well.

How Credit Unions Can Appeal to Millenials

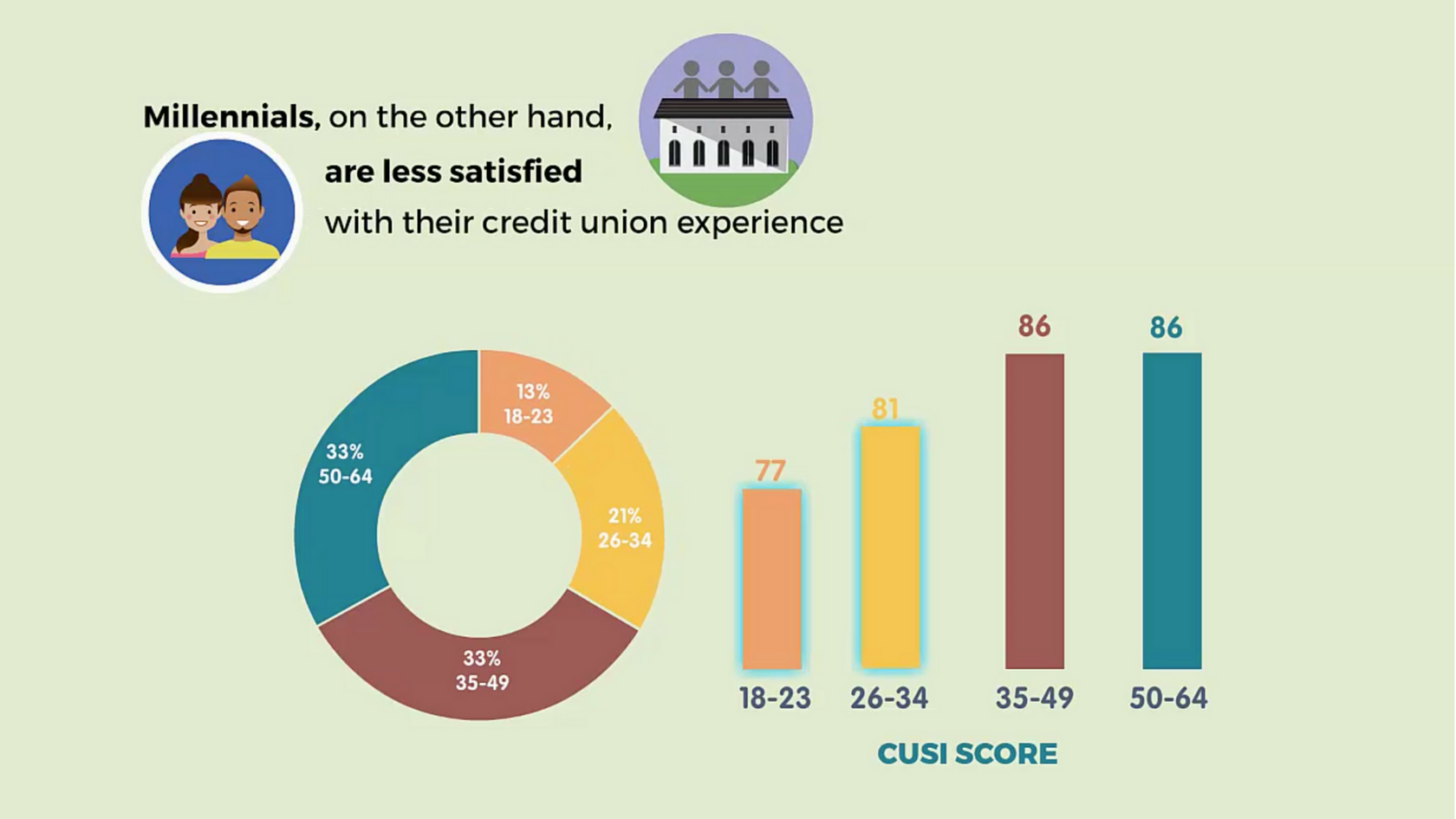

Boomers and Gen-Xers have a fairly high satisfaction level with Credit Unions. Millennials, not so much. Millennials are roughly between the ages of 18 – 34 and make up about 42 percent of the US population. Many of them are coming into their financial own, possibly needing financial products as they navigate college, first homes, and saving plans as they start new careers.

According to a CFI study, the CUSI (Credit Union Satisfaction Index) score is lowest among Millennials. This could have detrimental effects on membership growth among this population since Millennials tend to trust brands and services based on recommendations of others. A low satisfaction score translates into a low adoption of other products and referrals to their family and friends.

One of the main reasons for the lower satisfaction score is the digital experience gap. The Millennial generation is much more digitally connected and comfortable with online transactions than previous generations. Targeting Millennials and increasing overall customer satisfaction will require credit unions to reduce the effort it takes to do business with their institution. Obstacles, such as members having to repeatedly contact the credit union or repeat information, can be eliminated with the use of technology like Quiq, which enables customers to easily connect with their institution over their mobile device and at their convenience.

One of the main reasons for the lower satisfaction score is the digital experience gap. The Millennial generation is much more digitally connected and comfortable with online transactions than previous generations. Targeting Millennials and increasing overall customer satisfaction will require credit unions to reduce the effort it takes to do business with their institution. Obstacles, such as members having to repeatedly contact the credit union or repeat information, can be eliminated with the use of technology like Quiq, which enables customers to easily connect with their institution over their mobile device and at their convenience.

According to a FICO survey on Millennial banking, a large percentage of the Millennial generation feel that their bank does not communicate with them through their preferred communication channel. Mobile apps, text messaging, and the bank’s mobile website are the preferred methods of communication. Credit Unions have the opportunity to build a multi-channel digital engagement approach using the channels most attractive to Millennials.

“43% of Millennials don’t think that their bank communicates to them through their preferred communication channels.

~Fico, Millennial Banking Insights and Opportunities”

It’s not just Millennials who want to message you; 66% of customers prefer mobile messaging for contacting a company because it is easy and more convenient than making a call or sending an email. Building and maintaining a relationship with these customers doesn’t need to be just a one-way street. Credit unions have personal relationships with their members, so facilitating a two-way conversation via messaging is critical. Quiq clients have found that engaging with customers to answer questions is just as important as the ability to send outbound text messages with new product and promotion alerts.

At Quiq, our clients have seen a 5-10% higher customer satisfaction rate for messaging than any other channel. It is clear that consumers are already comfortable with using messaging to resolve issues and receive information. This could not be more true for Millennials. In a research study conducted earlier this year, Quiq discovered that 76% of Millennials “view messaging as an extremely/very effective channel” as compared to 58% of non-Millennials.

Cater Your Engagement to Younger Generations With Quiq

Quiq offers the messaging solution organizations need to attract all generations, especially Millennials. Our messaging solution allows all members to start or continue a personal one-on-one conversation over their preferred communication channel with your organization. Request a demo to see how easily your Credit Union can implement Quiq messaging and grow their Millennial membership.